Solar Income Tax Credit Extended Through 2034!

Great news for home and business owners who want to go solar! On August 16, 2022, the Inflation Reduction Act was signed into law by President Biden. Within this legislation are clean energy provisions that will result in:

- Lower energy costs for Americans

- Greater domestic energy security

- Improved grid resiliency

- Tens of thousands of new living wage jobs

- Development of new manufacturing facilities

- Decarbonization of all sectors of the economy

- And increased environmental justice.

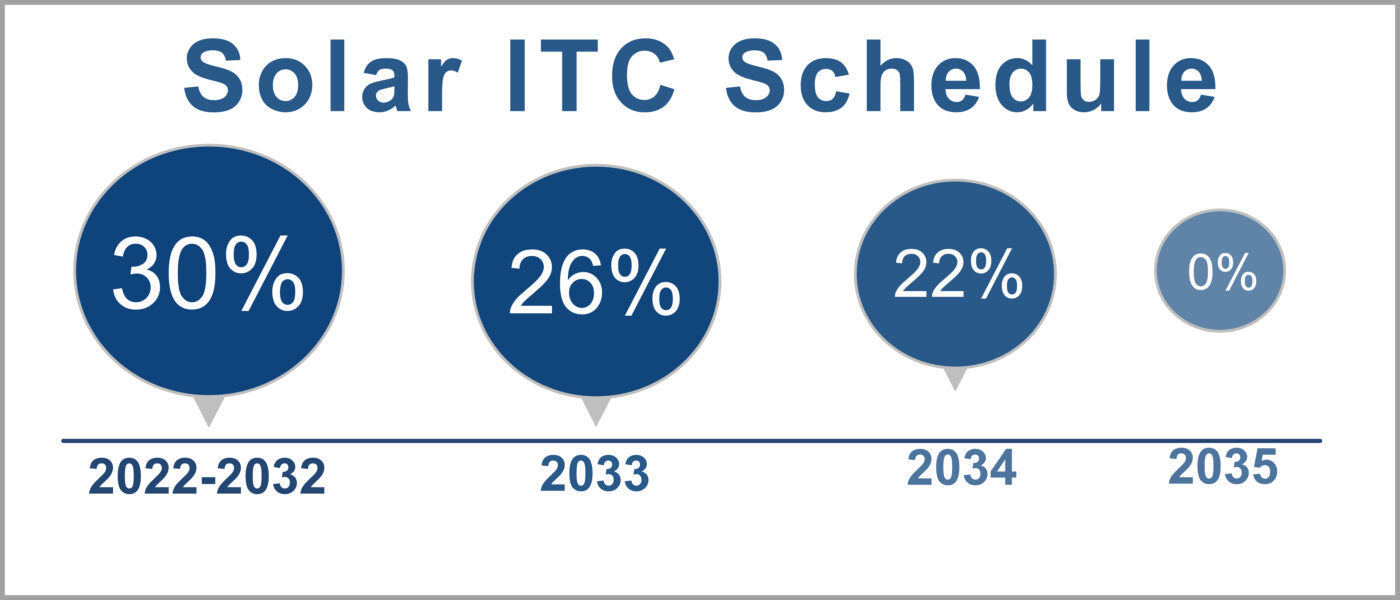

For those who want to go solar, the most impactful provision in the bill is the long-term extension of the solar Investment Tax Credit (ITC). Originally scheduled to be 26% in 2022, 22% is 2023, and to expire for residential projects in 2034, the solar ITC has now been increased and extended.

Here are the highlights of the federal solar tax credit for residential solar installations:

30% tax credit if placed in service between 2022-2032

30% tax credit if placed in service between 2022-2032- 26% tax credit if placed in service in 2033

- 22% tax credit if placed in service in 2034

- Includes all storage systems of at least 3kWh, whether or not it’s paired with solar

This means that all installations of solar systems in 2022 are now retroactively eligible for a 30% Federal Income Tax Credit, and those that have signed contracts with Fire Mountain Solar for 2023 will get 30% instead of 22%.

Energy Storage Incentive

Another exciting benefit of the new solar income tax credit is that the 30% income tax credit also applies to energy storage, whether or not it is paired with solar. Which means if you are wanting to add batteries for grid outages but can’t or don’t want to include solar, you still benefit.

Federal Solar Tax Credit for Businesses and Other Non-Residential Systems

Commercial solar projects also benefit from the new solar Investment Tax Credit. Small businesses can take the 30% tax credit, however, for large commercial solar systems over 1 Megawatt (AC), certain conditions must be met in order to qualify for the full amount.

Non-residential solar electric systems qualify for a 30% investment tax credit if:

- The solar system size is <1 MW AC; or

- The solar system size is >1 MW AC and

- Prevailing wage rates are paid and apprenticeship requirements are met.

Additional Tax Credits for Businesses

Non-residential bonus credits are available that some businesses may be eligible for on top of the 30% ITC:

An additional 10% bonus credit if the project is developed in a community where a coal mine or power plant has been closed or that has seen employment losses as a result of contractions in the fossil fuel economy.

An additional 10% bonus credit if the project is developed in a community where a coal mine or power plant has been closed or that has seen employment losses as a result of contractions in the fossil fuel economy.- An additional 10% bonus credit if using Domestic Content

And though options for U.S. manufactured solar products are currently limited, there are additional tax incentives in the Inflation Reduction Act to spur domestic manufacturing and recycling of clean energy products, which means in the near future more Made in the U.S. options may be available.

Business ITC (non-residential) is based on when a project starts:

- 30% credit if commence construction by the end of 2032

- 26% credit if commence construction in 2033

- 22% credit if commence construction in 2034

- 10% credit if commence construction after 2034

Frequently asked questions about the federal solar tax credit

Note: The information provided here was gathered from publicly available sources generally accepted as reliable. However, we recommend that you contact the IRS, your tax preparer or your financial advisor for professional financial guidance.

How do I know if I am eligible to receive the federal solar tax credit?

Date of installation:

Date of installation:- For residential systems you can claim the residential clean energy credit in the year the system went into service on your home. It does not matter when you paid for the system.

- For non-residential systems the investment tax credit will use the construction commencement date.

- Location: Your solar electric or energy storage system must be installed on your primary or secondary residence in the United States. Rental properties and commercial properties that are not owner occupied do not qualify for the residential clean energy credit but are eligible for the business investment tax credit.

- Ownership: You must own the solar electric or energy storage system, meaning you purchased it outright or financed it with a loan. You cannot take the tax credit if you lease a solar system.

- Original Installation: Your solar electric or energy storage system must be new or being used for the first time. The credit can only be claimed on the original installation of the equipment – if you bought a house that came with a solar system already installed, you are not eligible for the credit.

Claiming your residential solar tax credit

Residential taxpayers can apply a credit based on the total price of the solar system to their federal income tax bill at the end of the year in which their system went into service. The solar tax credit can be carried forward to future years if you can’t use the full amount in one year, but it’s still unclear how many years you can carry your tax credit forward.

- File IRS Form 5695 as part of your tax return

- In Part I, calculate the credit of the tax form

- File your solar system as “qualified solar electric property costs”

- On line 1, enter your project’s total costs as written in your solar contract

- On lines 6a and 6b, complete the calculations

- On line 14, calculate any tax liability limitations using the IRS’s Residential Energy Efficient Property Credit Limit Worksheet

- On lines 15 and 16, complete the calculations

- On line 5, enter the exact figure from line 15 on your Schedule 3 (Form 1040)