Cost, Incentives, and Taxes

Phil Mandel2023-01-27T11:30:44-05:00Cost, Incentives, and Taxes

This section focuses on the financial topics of going solar, so you can decide if solar is the right investment for you.

Want to reach FMS? Send us a message or give us a call directly at (360) 422-5610 and speak to someone who can help!

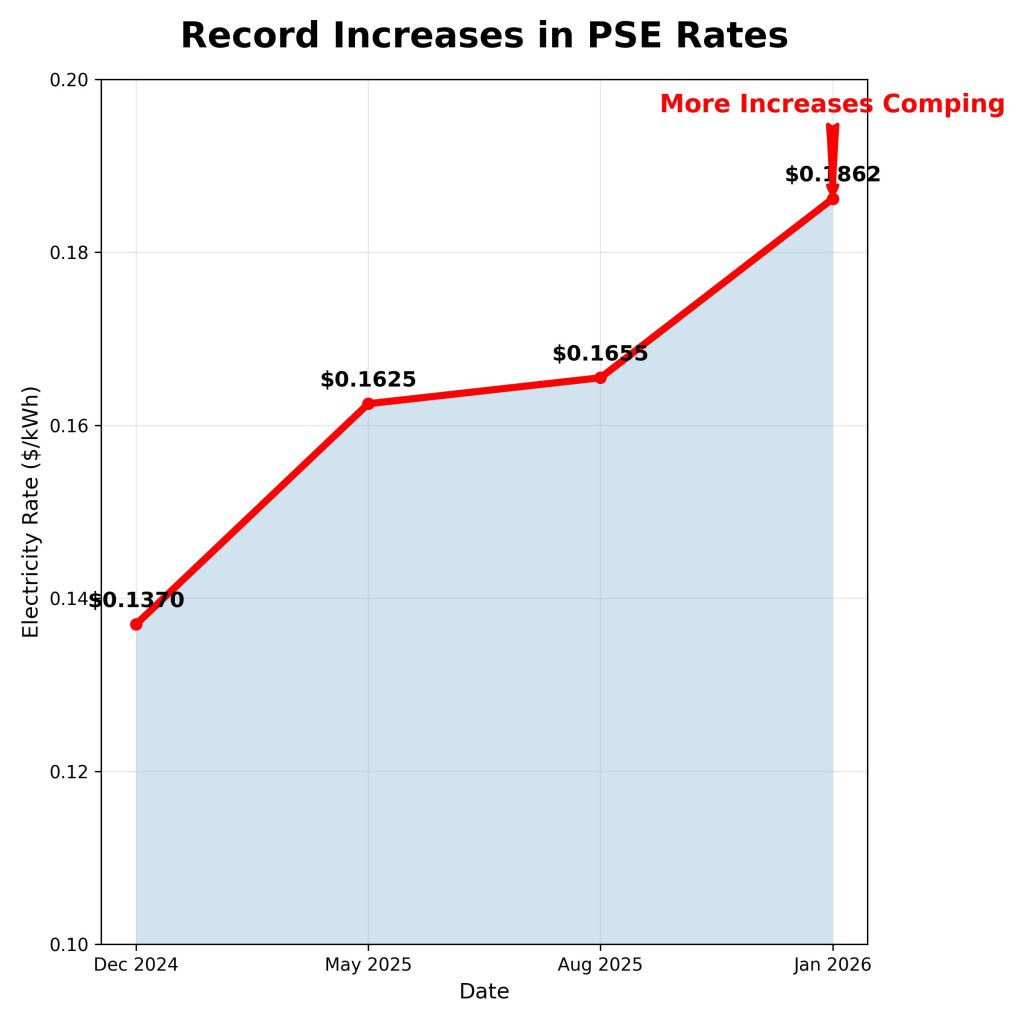

PSE Rates Jump Over 12% in January 2026

After record increases in 2025, PSE electricity rates took another big jump in January 2026, with more increases coming. Invest in solar now to protect yourself.

Changes to Net Metering on the Way in Washington

An increasing number of Washington utilities are reassessing how they compensate for solar sent to the grid. Are net metering programs at risk of ending soon?

Record Increases in PSE Rates Make Solar Investment Smarter Than Ever

Affordable electricity is now a thing of the past in Washington, especially if you are a Puget Sound Energy customer. Here’s what’s going on.

Protect Yourself from Rapidly Rising Energy Costs and Demand by Going Solar

Demand for electricity is rapidly rising, driving up utility rates and causing shortages. But solar and energy storage offer protection against these challenges.

PSE Flex Batteries Rebate Program

You may be eligible to receive up to $10,000 towards the upfront cost of your battery in addition to $1,000 per battery, plus up to $500 per year!

Solar: Cost Shift or Net Benefit?

Is solar cost shifting a myth? Does your solar benefit your neighbors who don’t have it? Washington lawmakers seek definitive answers from objective study.

PSE Extends Net Metering

Puget Sound Energy (PSE) has extended net metering to Customers that have applied until December 31, 2025, or when a replacement is in place for new Customers

Is Solar a Good Investment?

Many people ask us, Is Solar a Good Investment? The short answer is Yes! Find out why solar is one of the most secure investments you can make.

Claiming the Solar Tax Credit for Your New Roof

Some solar companies say you can include the cost of your new roof when claiming the federal solar tax credit. But that advice could end you up in hot water.

Solar System Payback

You often hear people talking about solar system payback. But how long it takes to recoup your upfront cost of solar doesn’t tell the whole story.

How Much Does a Grid Tie Solar System Cost?

One of the first questions people ask about solar is ‘how much does it cost’? Read our guide that overviews grid tie solar system cost factors to learn more.

Net Metering

Net metering lets you “bank” your excess generated solar power with your utility for later use. Find out more about this very important solar incentive.

How to Save Money on an Off Grid Solar System

Going off grid can be an investment. Read How to Save Money On An Off Grid System, for money-saving tips for powering your busy life off the grid!

Incentives for Solar

Incentives like the federal ITC, net metering and REAP grants help make going solar an excellent investment.